Quick Contact

26th July 2017

Sending money is simple. You just send it through your bank, right? It’s a great option, yes, but not when you’re overseas. With poor exchange rates and multiple fees, the costs of the service can add up considerably.

If you need to send money overseas from Australia – whether it be for personal reasons like sending money home to your family, or for business reasons like paying an overseas supplier – it’s a good idea to consider other means of transferring.

We’ve listed some international money transfer alternatives to help your money stay your money.

International transfers with your bank

Banks are a bit like a Swiss Army Knife for your money. But, their huge range of services do have drawbacks. It can mean a less personal, less bespoke service and higher costs. In fact, when compared to other money transfer services, we can see that banks can be quite expensive.

Firstly, they tend to charge high fees, as well as increase the margin on the exchange rates they offer with overseas money transfers. So, while it may be more convenient to use your regular bank for your overseas transfer, it’s likely to cost you more.

Let’s have a look at the fees and exchange rates big Aussie banks charge for their international money transfer services*.

If you sent $1,000+ AUD overseas, there’s a difference of 4,025 Indian Rupees between the bank with the best exchange rate and the bank with the worst – and then you need to take their fees into consideration.

But what other options are there?

Large transfers with Travel Money Oz

For international money transfers over $10,000, we’d recommend using GlobalSend. With their services, you can make the most of competitive exchange rates and having a dedicated account manager to make the process that much easier.

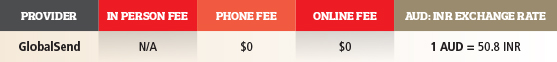

Let’s see how GlobalSend fits on the table.

The difference in exchange rate and fees is staggering. When sending over $10,000 with GlobalSend, there are no fees for any money transfer transaction (over the phone or online).

GlobalSend offers you a team of currency exchange specialists whose only business is to send money overseas on behalf of their customers. You get a personal account manager, and a convenient, personalised service – 6 days a week, with extended hours available to you. It's the perfect money transfer option for those that have large sums of money to transfer for personal or business reasons.

Transferring money overseas doesn’t have to be tricky and costly. From more information on the services mentioned above, drop into your local Travel Money Oz store today.

*International money transfer fees and exchange rates for HSBC, ANZ, NAB, Westpac, CBA and GLobalSend are accurate as at 24 July 2017 and are subject to change daily. Bank fee Information is taken from https://mozo.com.au/international-money-transfer.

**Fee of AUD3.50 applies to sends up to $100 for cash pick-up only. Subject to agent hours of operation, public holidays, local laws and regulations. In addition to the transfer fee, a currency exchange rate may also apply.

^Rate accurate as of 25th July 2017. For up to date rates click here.

+$18 fee applies for sends of AUD1000 to India only. Transfer fees vary based on the service option and transfer amount. Prices are subject to change.

This blog is provided for information only and does not take into consideration your objectives, financial situation or needs. You should consider whether the information and suggestions contained in any blog entry are appropriate for you, having regard to your own objectives, financial situation and needs. While we take reasonable care in providing the blog, we give no warranties or representations that it is complete or accurate, or is appropriate for you. We are not liable for any loss caused, whether due to negligence or otherwise, arising from use of, or reliance on, the information and/or suggestions contained in this blog.