Quick Contact

26th July 2018

You’re two weeks out from your dream holiday to the USA. After months of saving you have calculated that you can finally afford to see your dream show on Broadway (or buy 83 cheeseburgers from In-N-Out… no one is judging). However, your dreams of Broadway and burgers are cut short after a recent drop in exchange rates has left a rather unwelcome dent in your spending money.

Volatility in exchange rates can catch even the most researched traveller unawares, especially when the changes can be a result of political activity across the globe.

For many people, the happenings of politics are often tuned out as background noise on the TV when we eat our breakfast or wait for our favourite prime time program to start. Whilst it isn’t the sexiest of topics, it certainly pays to understand how political decisions can affect you and, in this instance, your travel money.

At Travel Money Oz we understand that this can sometimes be pretty boring, and often quite complicated. With this in mind, we have simplified how political decisions lead to exchange rate volatility, as well as compiled some tips and tricks to help minimise the effect on your travel money the next time you head overseas.

So, how do exchange rates affect travel money?

The amount of money you have for your holiday is ultimately determined by two things:

1. How much money you have saved

2. The exchange rate

You can find some tips for saving for your holiday here. Though, that part is largely determined by you.

Your savings are then multiplied by the current exchange rate to determine the equivalent in your destinations currency.

For example: If you are going to New York you need to convert your Aussie Dollars (AUD) to US Dollars (USD). So, if you have saved $2000 AUD and the exchange rate is 1AUD = 0.75USD, you need to multiply your $2000 by 0.75. If this was the case, you would be hitting the Big Apple with $1500USD.

The foreign exchange market is traded on 24/7. This means the exchange rate can change by the second. Each morning, rates in stores are set for the day (so don’t stress about losing money by the second), and will determine how much 1AUD can get you in each currency.

As you can see by the below graph, the daily changes can be quite dramatic and, depending on how much you are exchange, can result in a significant difference to your spending money.

AUS to USD.JPG

Caption:

AUD to USD fluctuations from June 23 2018 to July 23 2018

Exchanging $2000AUD on the 2nd of July 2018 (1AUD = 0.7133USD) would have given you $1426.60USD. The same amount on 9th of July 2018 (1AUD = 0.7255USD) increased your spending money to $1451.

A seemingly small difference in the exchange rate gave customers an extra $25USD in their back pocket. Perfect for a classic I <3 NY t-shirt, or an upgrade to your seat at a Broadway show.

Why do exchange rates move up and down so much?

A key reason currencies fluctuate so much is because they are traded using a ‘floating exchange rate’. Long story short, it means currency is bought and sold on the international market using a supply and demand system. The more a currency is in demand the more it will cost an investor to purchase. In return, if a currency is less sought after, the price will drop to try and entice investors.

Crazy, hey? Wait though, there is a bit more to it.

Investors are there to make money, so they forecast and buy currencies they predict will go up in value.

Signs that a currency will increase in value include economic growth of a country, a country’s economic environment (like consumer behaviour and trading partners), trading data on stock exchanges, and government policy.

The cumulative changes (good and bad) to a country’s economy can trigger an increase or decrease in the value of their currency, and it is these triggers that investors look out for.

Changes are often reflected in economic data, which then impacts exchange rate forecasts and, in turn, demand for the currency.

For example: If the Australian government was to release figures showing unemployment rates had increased in the past 5 years, it may signal to investors that there has been an economic slowdown. The resulting lack of confidence in the strength of the Australian economy may mean investors are less likely to buy AUD. This decreased demand can then lead to a decrease in value, meaning your online shopping cart for that US website will get a whole lot more expensive.

Making sense so far? Either way, grab some half time oranges; we are getting to the pointy end.

Where do politics fit in to all of this?

So, we can see that economic data can affect the perceived value of a currency, and how this value is then reflected in the exchange rate between currencies (and your travel money).

Politics – a-k-a government policy and decisions - feed into this economic data and can further affect movements in currency. The government can have both a direct and indirect influence on exchange rates.

Indirect

1. When a government policy has been established with the intention of achieving one goal, but has indirectly affected the value of a country’s exchange rate.

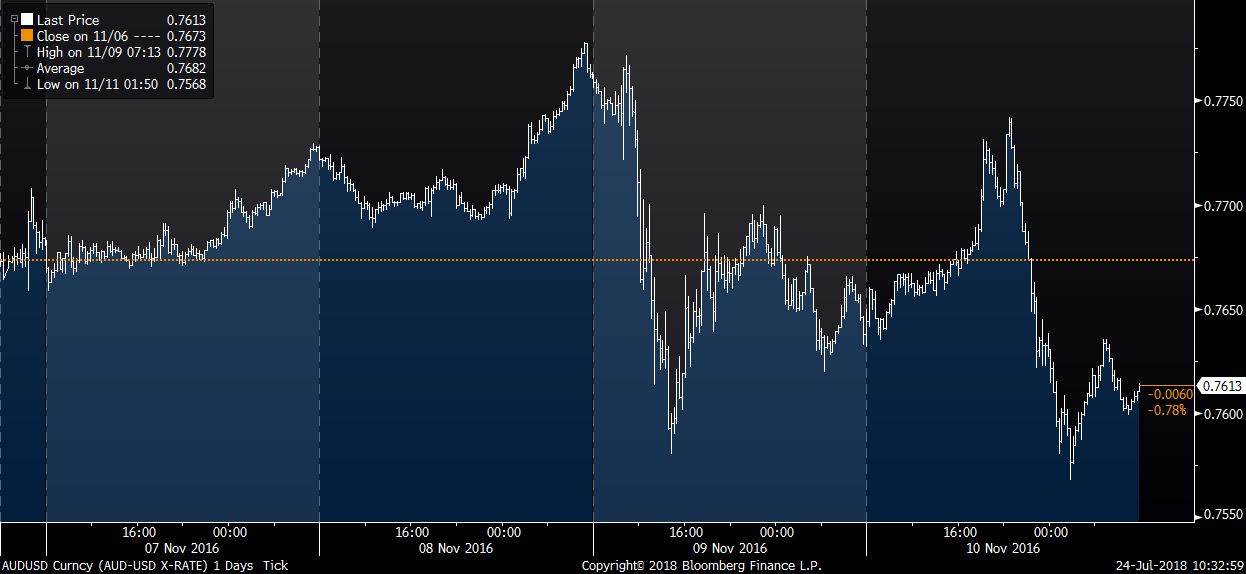

Two of the biggest political events that have indirectly impacted foreign exchange markets in recent times are the presidential election in the USA, and the decision by the UK to exit the European Union (also known as Brexit). The likelihood of these events occurring were considered so unlikely by the general public, and the voting so close, that they produced very large swings in the foreign exchange markets.

1 AUD purchased around 0.7700 USD in the lead up to the US election, but as the results started trickling in, that rate increased to 0.7775 then moved down to 0.7575, back up to 0.770, down to 0.7640, back up to 0.7750 and then back down to 0.7560. In other words, hold on to your toupee because these rate swings will give you whiplash.

Trump election.png

Caption:

Fluctuations in the USD as a result of President Trump's election on 8 November, 2016

Brexit was considered by most to be extremely unlikely, but much to everyone’s surprise the unthinkable happened. In the lead-up to the vote, 1 AUD bought around 0.5100 GBP. As voting results came through and it became apparent that the ‘Leave’ vote was going to win, the GBP lost value rapidly, trading as high as 0.5525 later on in the day. In the space of a day, $2000AUD went from getting Aussies $1020 to $1105. That’s an extra $85 to spend on scones and Royal Wedding memorabilia – party time.

Brexit.png

Caption:

GBP fluctuations during Brexit

2. When governments work to indirectly manage the exchange rate due to a vested interest in setting a ‘target’ value of the currency.

Australia relies heavily on exports for economic growth. It’s not beneficial to have a super strong Aussie dollar as it will push up the price of exports; countries buying our coal, iron ore and wheat will consequently go elsewhere to find these goods at a cheaper price.

The Reserve Bank of Australia (RBA) will work towards a target value for AUD that supports economic growth through exports. Whilst this is great for the Australian economy, it’s not so great for Aussies heading overseas wanting a good rate on their foreign exchange.

Direct

Governments can directly manage exchange rates by ‘pegging’ the rate of their currency to that of another. For example, Argentina has pegged the value of their Peso to the value of the USD. This means the value of the Peso is fixed to the USD and is affected by its rises and falls.

How can you protect your travel money from economic and political effects?

As you can see, there are a number of factors at play that can impact the amount of spending money you have on your next holiday.

Short of becoming the Prime Minister and making your own political decisions, there isn’t a lot you can do besides planning ahead to minimise your exposure to market volatility.

As Travel Money experts, we have a few tips and tricks to make this process easier for you:

1. If you are super budget conscious, consider picking a location where the exchange rate is strong and you can get more bang for your buck.

2. Plan out your holiday budget well in advance with our budget tool in store or online

3. Once you have booked your holiday, set up currency alerts and let us do the monitoring for you. We will send you an email when the currency you need reaches a certain rate against the AUD.

4. By planning ahead and exchanging your travel money regularly rather than in one lump sum, you can minimise the amount of money that is exposed to potential market volatility at any one time.

5. Protect your money with Rate Guard, which is our way of protecting you against exchange rate movements. Simply purchase with us in store, and if the retail exchange rate improves within 14 days we will pay you the difference.

6. Load your money and lock in your exchange rate with a Travel Money Oz Currency Pass.

7. Save some money and ensure your currency exchange provider doesn’t charge fees or commissions (hint hint, nudge nudge, Travel Money Oz doesn’t charge any fees or commissions).

So there you have it, a crash course in exchange rates and how economic and political factors can effect the amount of spending money you have for your next holiday.

For more information, or to get your holiday cash, speak to one of experts in store today.

This blog is provided for information only and does not take into consideration your objectives, financial situation or needs. You should consider whether the information and suggestions contained in any blog entry are appropriate for you, having regard to your own objectives, financial situation and needs. While we take reasonable care in providing the blog, we give no warranties or representations that it is complete or accurate, or is appropriate for you. We are not liable for any loss caused, whether due to negligence or otherwise, arising from use of, or reliance on, the information and/or suggestions contained in this blog.