Travelling overseas is an incredible experience, but it does make you realise how many social cues and customs that are at play in Australia do not exist overseas.

In fact, they're usually replaced by a whole new suit of words, gestures and sayings....and preferred ways of payment!

We understand that knowing the best way to carry your spending money can be a local language in itself, so we’ve compiled the following guide for your travels to the USA, UK, South East Asia and New Zealand to ensure that, if nothing else, you can at least Speak the Local Lingo of your destination with your spending money.

USA

Just like Miley, you’ve hopped off the plane at LAX with a dream and your cardigan.

Despite being confused that ALL of the notes look the same, people are speaking English and you’ve heard that a Maccas small here is the same as a large in Oz so, really, you don’t have a care in the world.

Keep it that way, by trying out the following tips.

- Be sure to have plenty of cash on hand for tips. Sure, they may get a bit greasy when you are handing them over after your burger, but we can guarantee the waitress would prefer a greasy fiver over no tip at all.

- Despite what is shown in movies, try not to summon the waiter/ waitress with a clap, snap or calling out. Simple eye contact and a smile will let them know you need service or the bill.

- French Fries are hot chips and crisps are chips. Sometimes, to keep you on your toes, they serve crisps with burgers for the ultimate culinary wonder. There is also the option to supersize everything. The answer is always yes – when in

Rome‘Murica, right? - You can pre-book a lot of attractions and shows online, so be sure to have a currency card with you. ATM’s are widespread as well, so you won’t have any trouble accessing funds.

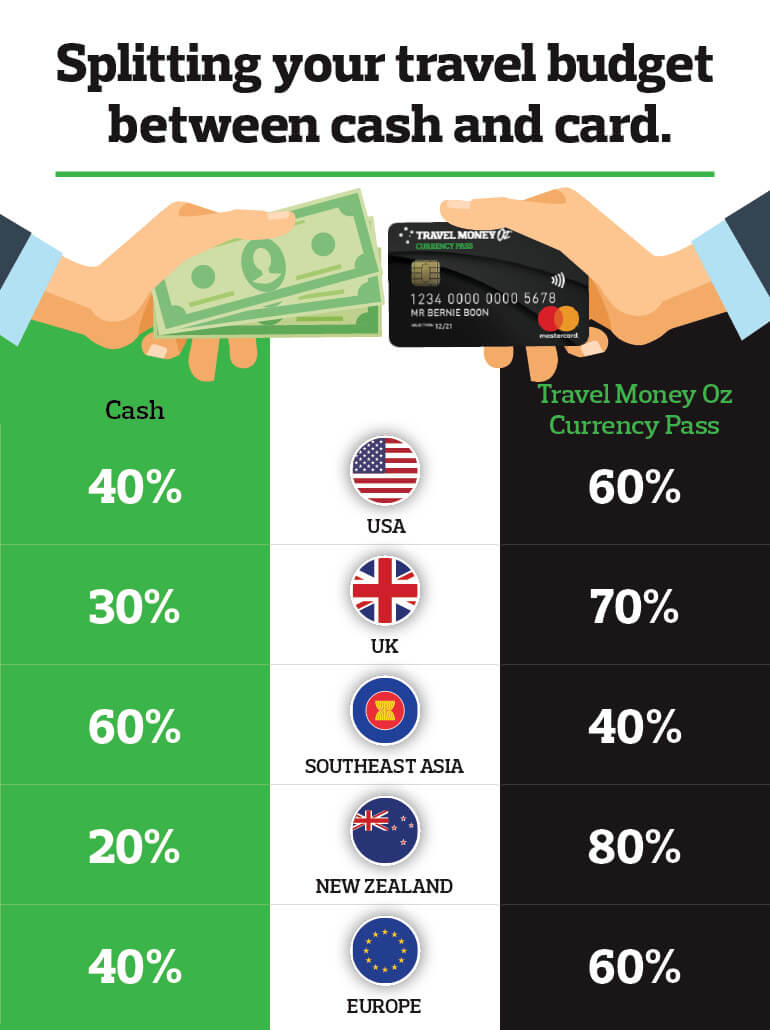

SUMMARY: Supersize everything, stick to the right and take a 60/40 split of cash and card. A.k.a – 60% of your money on a prepaid travel money card like the Travel Money Oz Currency Pass, with the rest being dollar dollar bills.

UK

Whilst we have a lot in common with our British ancestors - like a love for fish and chips, a pint at the local and a thick layer of sarcasm in every conversation – they still have a local lingo that can leave most Aussies scratching their head.

- The UK is pretty similar to Oz when it comes to a cash and card split. A lot of transactions are cashless, so swap your pennies for a Currency Pass and be on your merry way.

- Speaking of the Currency Pass, it can double as your Oyster card / means to swiping on and off the London Tube. Forget Tinder, swipe right with us.

- Some public restrooms will charge you to do your business, so it’s worthwhile having cash and some coins on hand (after you wash them, of course).

- Manners maketh man. Being polite and using your manners will go a long way. Don’t jump the queue, say please and thank you and never turn down a cup of tea.

SUMMARY: Be polite, use your currency pass on the tube and don’t assume everyone is from London. Carrying 70% of your currency on a prepaid travel money card and the rest as cash is the best way of dividing your funds.

South East Asia

The wonder that is South East Asia leaves many Aussies in a state of awe and confusion. The combination of new language, at least 50 unidentified smells and a colourfully, buzzing landscape can leave your head spinning.

- There are nine different currencies at play in South East Asia. Our team of experts can let you know which one(s) you will need for your adventure.

- Each Thai Baht note depicts the royal family, so be sure not to stand on, sit or throw any currency to avoid being disrespectful.

- Whilst ATMs are accessible in major cities they are few and far between in rural areas. With this in mind, Cash is King.

- Cash is generally the preferred, and often only means of payment available at markets and street vendors. Be sure to have smaller notes so you take up all of the vendors change. It can also be disrespectful to pay for a dish with a note that is the equivalent of their full days earnings.

SUMMARY: Be respectful and aware of the rich cultures at play, have plenty of cash to splash on weird and wonderful market delicacies (tarantula anyone?!) and educate yourself on what currency can be used. We recommend a 60/40 split, with 60% of your currency in cash form with a few different denominations. Safeguard the rest of your spending money on a Currency Pass.

New Zealand

Despite what both countries might otherwise say, Aussies and Kiwis have a lot in common when it comes to how they transact in day to day life.

- Our notes look pretty similar and we have the same philosophy when it comes to tipping. No need to tip for your fush-n-chups unless they provided some choice service or you’re looking to impress your date.

- They call eskies, chilly bins. Genius really.

- Allow for plenty of photo time. Take the road less travelled and enjoy a slower pace. Just like us they are a pretty friendly bunch who are happy to have a chat.

- More rural areas may not have phone reception or ATM access, so have some cash on hand in case emergency snack stops on your road trip.

Summary: Sheep out the wazoo, keep your drinks in a chilly bin and relax. Treat your money the same way you would here at home, and take a mix of cash for smaller purchases and a Currency Pass for everything else.

Still confused on how to best manage your foreign currency when overseas? Or perhaps your destination wasn’t covered here?

Don’t stress, the experts at Travel Money Oz have you covered with all the tips you need. So pop in store before you go, and let us translate your AUD into the local lingo.

This blog is provided for information only and does not take into consideration your objectives, financial situation or needs. You should consider whether the information and suggestions contained in any blog entry are appropriate for you, having regard to your own objectives, financial situation and needs. While we take reasonable care in providing the blog, we give no warranties or representations that it is complete or accurate, or is appropriate for you. We are not liable for any loss caused, whether due to negligence or otherwise, arising from use of, or reliance on, the information and/or suggestions contained in this blog.